Worthwhile

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

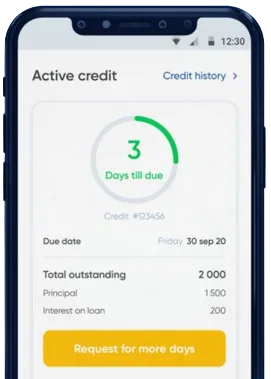

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Initiate your application on our app by completing the required form.

Hold on for our response, coming in just 15 minutes.

Have the money transferred to you, usually within one minute.

Initiate your application on our app by completing the required form.

Download loan app

In recent years, the popularity of phone loan apps in Kenya has been on the rise. These apps offer a convenient and efficient way for individuals to access quick and easy loans directly on their mobile devices. With the increasing demand for financial assistance, phone loan apps have become a valuable resource for many Kenyans.

One of the key benefits of phone loan apps is the convenience and accessibility they provide. Unlike traditional bank loans that require lengthy application processes and approval times, phone loan apps offer a quick and hassle-free way to access funds. With just a few taps on your smartphone, you can apply for a loan anytime and anywhere, making it a convenient option for those in urgent need of financial support.

Additionally, phone loan apps typically have minimal requirements for eligibility, making it easier for individuals with limited financial histories to qualify for loans.

Another advantage of phone loan apps is the speed and efficiency with which loans are processed. Unlike traditional banking institutions that may take days or even weeks to approve a loan, phone loan apps can provide funds in a matter of minutes. This quick turnaround time is particularly beneficial for individuals facing urgent financial needs or unexpected expenses.

Phone loan apps use innovative technology to streamline the loan application process, reducing the need for extensive paperwork and lengthy approval procedures. This efficiency allows borrowers to access funds quickly and without delay, providing them with much-needed financial relief.

Phone loan apps also offer flexibility and customization options for borrowers. Users can choose the loan amount and repayment period that best suits their financial situation, allowing them to tailor the loan terms to meet their individual needs. This flexibility is especially useful for individuals with varying income levels and repayment capabilities.

Phone loan apps in Kenya often provide excellent customer support and assistance to borrowers. With dedicated customer service teams and online help resources, users can easily get answers to their queries and resolve any issues they may encounter during the loan process. This support ensures a smooth and efficient borrowing experience, helping borrowers navigate the loan application and repayment process effectively.

Overall, phone loan apps in Kenya offer a range of benefits and advantages for individuals in need of financial assistance. From convenience and accessibility to speed and efficiency, these apps provide a modern and efficient solution for accessing quick loans. With their flexibility, customization options, and excellent customer support, phone loan apps have become a valuable resource for many Kenyans seeking financial support.

Phone loan apps are mobile applications that allow users to borrow money directly from their phones without the need for physical paperwork or collateral.

In Kenya, phone loan apps typically require users to download the app, create an account, and submit certain personal information for verification. Once approved, users can request a loan through the app, which is usually disbursed directly to their mobile money account.

Eligibility criteria for phone loan apps in Kenya vary by app but usually include being a Kenyan citizen or resident, having a valid ID, being of legal age, and having an active mobile money account.

Interest rates and repayment terms for phone loan apps vary by app but generally have higher interest rates compared to traditional loans. Repayment terms are usually short, ranging from a few days to a month.

If you are unable to repay your loan on time, you may incur additional fees or penalties, and your credit score with the loan app may be negatively affected. In some cases, your information may be shared with credit reference bureaus.

While phone loan apps can provide quick and convenient access to credit, users should be cautious of potential risks such as high-interest rates, hidden fees, and data privacy concerns. It is important to thoroughly read and understand the terms and conditions before using any phone loan app.